This is our inaugural Battery & Energy Storage System – Supply Chain and Pricing Report, which we intend to publish on a quarterly basis going forward. Our sales and support teams field an increasing number of inquiries related to all things battery energy storage system (BESS) supply. Given the importance that BESS supply chain issues have on pricing and lead times, we felt compelled to publish a report that summarizes key market drivers and trends. The data and insights in this report draw from reputable industry trade press outlets, research firms, and discussions we have directly with BESS vendors.

Battery and energy storage global supply chain disruptions hit an all-time high in the first quarter of 2022. This has been caused by a confluence of factors, including ongoing supply chain disruptions stemming from COVID, soaring raw material prices, strong continued EV demand, record-high inflation, and increased shipping and transportation costs. This perfect storm of related issues has resulted in longer lead times and upward price movements of up to 20 – 30% in the cost of energy storage systems. We unpack each of these in more detail below.

COVID Disruptions

Lockdowns to mitigate the spread of COVID-19 continued across multiple Chinese provinces into April. Though major air and ocean ports remain open in China, labor shortages are slowing operations, availability of goods has dropped since manufacturing and warehouses are closed, and trucking is limited due to quarantine rules and travel restrictions.

- Ports like Yangshan are reportedly operating at only 50% capacity. Last year’s outbreak at Shenzhen’s port of Yantian caused a 70% reduction in operations for nearly a week and resulted in a 20% spike in ocean rates to the US and Europe, reported the Journal of Commerce[i].

- With limited goods available to ship due to reduced production output and lower inventory levels, demand for air cargo decreased sharply, forcing many carriers to cancel flights out of Shanghai Pudong airport, further compounding existing backlogs and delays, reported the Journal of Commerce.

Raw Materials

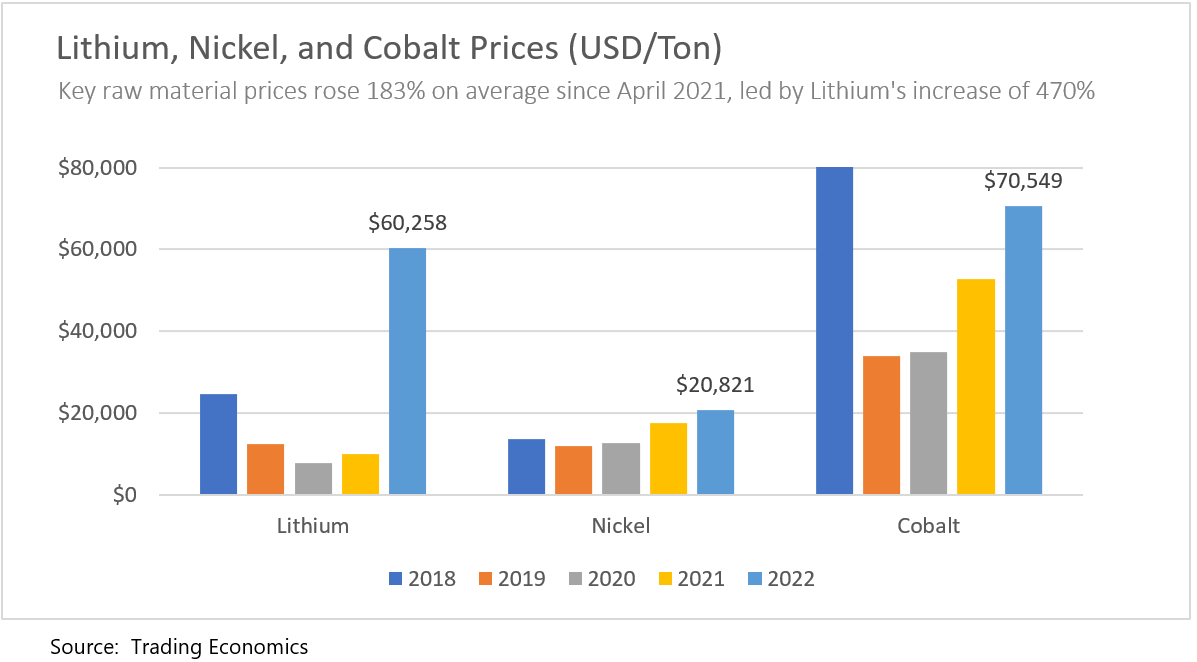

According to a report conducted by Lawrence Berkeley National Laboratory, prices for raw materials that make up Lithium-Ion-based BESS, such as lithium, nickel, and cobalt make up between 60 – 80% of total battery cell costs[ii]. These raw material prices have seen significant increases since the beginning of 2021 due to COVID-related manufacturing disruptions, strong EV demand, increasing energy input costs, high supply concentration, and geopolitical disruptions have been the primary drivers of recent raw material price volatility.

- The price of Lithium Carbonate soared to $79,600 per ton in Q1 2022, a 470% increase over the $13,800 price per ton paid on average in Q1 2021. Lithium prices appear to have plateaued, remaining at roughly $78,000 per ton since reaching that level in early March 2022. Research firm Trading Economics predicts that low inventory levels, unprecedented EV demand, and difficulties in finding and developing new sources of lithium indicate that prices will remain elevated throughout 2022 and into 2023[iii].

- Nickel prices rose 63% during Q1 2022 to an average of $31,000 per ton in March, its biggest quarterly gain since 2003 and a price level not seen since June 2007. Driven in part by China’s Tsingshan Holding Group, one of the world’s top producers, purchasing large amounts to hedge its short positions, average nickel prices spiked dramatically in the second week of March to just 3% shy of the all-time high of $49,000 per ton reached in April 2007 before returning to current support levels around $30,000 per ton. Current forecasts show Nickel prices remaining relatively flat to moderately elevated from current levels throughout 2022 per Trading Economics[iv].

- Cobalt prices were hovering above $80,000 per ton in March, up 16% this year and near their highest level since June of 2018. Currently averaging $82,000 per ton, Cobalt prices have increased 61% since the same time last year due to robust growth in rechargeable batteries and energy storage and continued supply-side limitations in Cobalt mining and production reports Trading Economics[v].

Electric Vehicles

Higher oil prices and changing attitudes towards the ecological impact of fossil fuels are helping to drive unprecedented growth in demand for electric vehicles around the globe. The EV industry, which consumes approximately 75% of global battery demand on average, is moving from its traditional NMC offerings to LFP chemistries reports research and analysis provider Statista[vi].

- Deloitte forecasts that after rising 157% to 3.2 million units in 2021, electric vehicle sales in China will cross 5 million in 2022[vii]. Deloitte also predicts a 29% compound annual growth in electric vehicle sales globally, totaling 32% of new car sales by 2030.

- Historically batteries with Nickel Manganese Cobalt (NMC) chemistry have represented more than 90% of batteries consumed by the EV sector. However, in 2021, EV makers began announcing models utilizing Lithium Iron Phosphate (LFP) battery chemistry which would be available globally and not just in China. Long-term supply agreements signed by Tesla, Volvo, and other large EV OEMs to secure LFP supply are leading to reduced available supply and elevated pricing.

- IEA and UBS forecasts indicate that demand growth for Lithium from EV and Energy Storage could exceed supply by 13x to 42x from 2020 to 2030, with other key metals like Cobalt, Copper, and Nickel also forecasted to see significant supply-demand imbalances over the same period[viii]. Even with some 2-3 megatons of additional capacity scheduled to come online by 2030, it will not be enough to close the widening gap.

Inflation

The first quarter of 2022 saw historical increases in prices paid by both consumers and producers. While average earnings continued to lag the broader inflationary curve in general, persistent tightness in the labor market is forcing employers to improve compensation packages to remain competitive in attracting and retaining top talent. To counteract rapidly mounting inflationary pressures, the US Federal Reserve announced measures to raise real interest rates and reduce the excess supply of money in circulation by $60 billion per month.

- The Consumer Price Index rose 8.5% in March, compared to the year prior, setting the highest year-over-year increase in 40 years[ix]. The Producer Price Index, which measures the average change in selling prices received by domestic producers of goods and services, recorded an 11.2% increase in March over the prior year[x]. These historical increases were driven largely by surplus money in circulation, lingering disruptions from the COVID-19 pandemic, and exacerbated by the Russian-Ukraine conflict.

- March saw unemployment fall to a historically low level of 3.6%. Labor force participation rates continued a modest climb, but remain at lows not seen since the late 1970s. With a record 11 million job openings reported in March the demand for labor remains strong, putting upward pressure on labor costs as companies face tough competition in hiring and retaining talent. Average earnings in the US rose sharply at 5.6% YOY but still lag general market inflation[xi].

- The US Federal Reserve announced in March that it would raise the federal funds rate target range by 25 basis points to 0.25% – 0.50%, in the first increase since 2018. 12 of the 18 members of the FOMC, the central bank’s rate-setting body, predicted at least seven total rate hikes in 2022[xii]. On the high end, one Fed official expects the central bank to raise rates above 3% during the year, from the level around 0.25% currently in force.

Shipping and Transportation

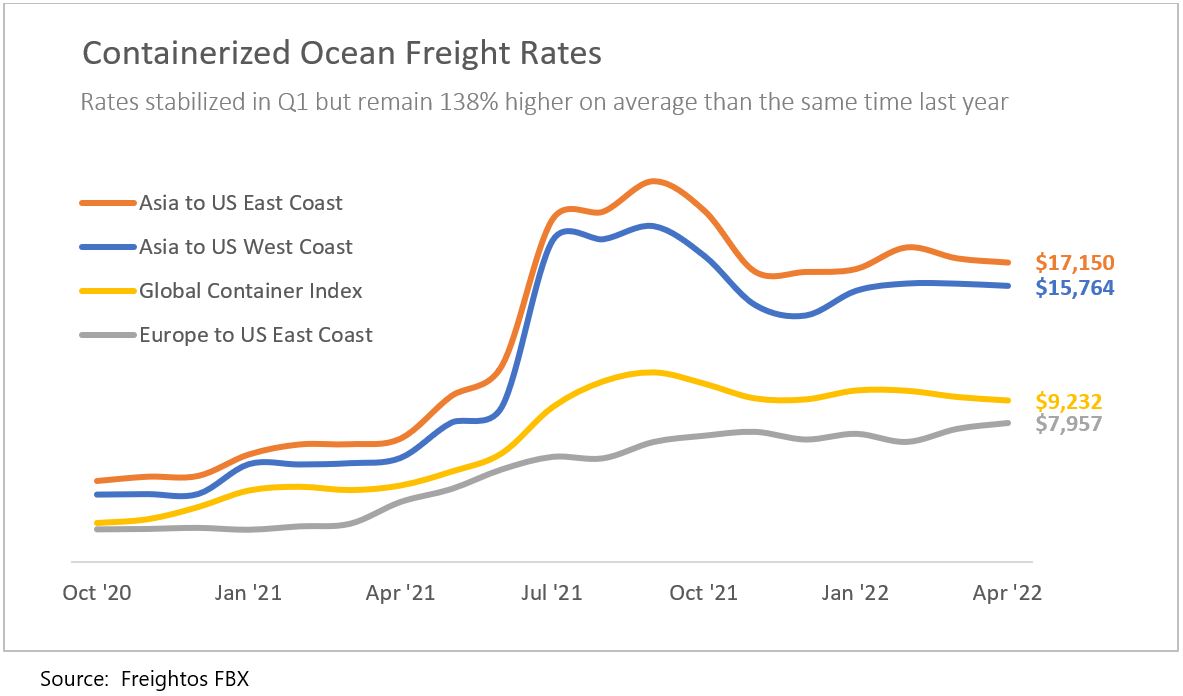

Shipping costs have rapidly increased throughout the COVID pandemic. The New York Times reported in March that the price to transport a container from China to the West Coast of the United States costs 12 times as much as it did two years ago, while the time it takes a container to make that journey has nearly doubled[xiii]. Prices have risen sharply across the entire freight sector, including in parcel delivery, trucking, rail, and warehousing, in addition to ocean shipping. Bloomberg reported year-over-year changes of domestic transport rising between 10 to 30%, the largest increases on record[xiv].

- The Journal of Commerce predicts strong transpacific volumes in the coming months, including some pull forward of summer demand to get ahead of peak season congestion and possible labor disruptions on the West Coast. But there are also growing signs that consumer demand is beginning to wane because of inflation, which may moderate congestion and price increases.

- Reefer and Van spot rates are down 7% and 10% since the start of the year, while flatbed rates rose 10% during the same period, owing in large part to fuel surcharges reaching contract parity with soaring diesel prices and seasonally lower rates in spring. Despite the modest declines seen in Q1 2022, average spot rates remain 13% higher YOY and 73% since the start of the pandemic in Q1 2020 according to the Journal of Commerce[xv].

- Reduced operational capacity for ground handling combined with existing backlogs and continued strong consumer demand were enough to push the Freightos Air Index to $11.92/kg in March, a 43% increase year-to-date and well above pre-pandemic levels of $2.35/kg on average[xvi].

How is ETB adapting to this environment?

The perfect storm of inter-related issues summarized above has led to a considerable tightening throughout the supply chain, resulting in longer lead times and upward price movements in the cost of energy storage systems we are quoting at Energy Toolbase. The challenging environment has forced ETB, along with BESS suppliers, integrators, storage project developers, and potential host customers to change their expectations. Energy Toolbase is committed to communicating clearly and promptly with our customers on changing prices and ESS lead times. Our team is in regular dialogue with our BESS vendor partners, to get as much foresight as possible on upcoming changes. This new quarterly report is meant to provide further transparency into why prices and lead times are changing, which our sales and support teams field an increasing number of inquiries regarding. For developers modeling storage projects on the ETB Developer platform, we provide a hyperlink to our current price sheets for all our publicly listed Acumen EMS integrated hardware partners. Additionally, when issuing formal ESS price quotes, we explicitly state the validity and expiration period of the quote. Talk to your Account Manager for more details on our quoting terms and durations.

“The positive news that we can report at Energy Toolbase is that we are continuing to see record ESS activity and demand, measured by ESS proposals generated on the ETB Developer platform, and closed ESS purchase orders that utilize our Acumen EMS controls software,” said our VP of Business Development, Adam Gerza. “The number of ESS proposals created on our sales platform utilizing our Acumen controls was up 39% in Q1 2022 vs. Q1 2021, while the number of Acumen controlled ESS projects sold increased 138% during the same period. Even in this rising price, long lead time environment, behind-the-meter, non-residential storage projects continue to pencil and make economic sense in certain markets.”

Brandon Maze is the Supply Chain Manager at Energy Toolbase. He previously worked at Amazon and Chevron. He is based in Waco, Texas.

Endnotes

- [i] (Journal of Commerce) Shanghai airport effectively closed as freight backlog builds amid COVID lockdown

- [ii] (UC Berkeley) Lithium-Ion Battery Supply Chain Considerations: Analysis of Potential Bottlenecks in Critical Metals

- [iii] (Trading Economics) Lithium pricing

- [iv] (Trading Economics) Nickel pricing

- [v] (Trading Economics) Cobalt pricing

- [vi] (Statista) Projected global battery demand from 2020 to 2030, by application

- [vii] (Deloitte) Electric Vehicles Setting a course for 2030

- [viii] (Seeking Alpha) Lithium Miners News For The Month Of March 2022

- [ix] (Bureau of Labor Statistics) CPI March 2022

- [x] (Bureau of Labor Statistics) PPI March 2022

- [xi] (FRED Economics Data) Federal Reserve Labor Force Participation Rate

- [xii] (Seeking Alpha) Most Fed officials predict at least 7 rate hikes in 2022

- [xiii] (New York Times) With Inflation Surging, Biden Targets Ocean Shipping

- [xiv] (Bloomberg) U.S. Freight Cost Blowout May Mean Little Inflation Relief Soon

- [xv] (Journal of Commerce) Truckload rate cooling may be ‘delayed seasonality’

- [xvi] Freightos Air Index