Editors note: On December 15, 2022, the CPUC approved the new NEM-3 billing plan. which will be implemented in April of 2023.

The California Public Utilities Commission (CPUC) released their much anticipated, revised Proposed Decision (PD) on the state’s “NEM-3” successor net metering tariff last week. The newly revised PD establishes a “Net Billing” tariff that introduces an entirely new framework for valuing exported energy. The new methodology will reduce the value of exported energy by roughly 75% compared to NEM-2 levels, and completely decouple the value of imported and exported energy. This will considerably erode the value of solar-only projects and create a strong price signal for pairing energy storage with solar.

This revised PD comes almost a year after the initial December 2021 PD ruling, which was withdrawn after widespread criticism, including an acknowledgment from Governor Newsom that the PD needed to be reworked. The newly revised PD contains a few key improvements from the original PD. Most notably, the new PD completely removed the Grid Participation Charge or solar tax, which sought to levy discriminatory fees on solar customers based on their interconnected PV system capacity. Additionally, the new decision removes the highly controversial language that sought to retroactively shorten the grandfathering period for “NEM-1” and “NEM-2” customers, thus preserving grandfathering for 20 years. These changes are victories for the rooftop solar industry, which lobbied hard to improve the PD over the last year, led by the California Solar and Storage Association (CALSSA) and the Solar Energy Industries Association (SEIA).

Key Issues of the New NEM-3 PD

Export Compensation Based on Hourly ACC Values

The value of exported energy will be compensated based on hourly Avoided Cost Calculator (ACC) values averaged across days in a month, differentiated by weekdays and weekends (e.g., 4-5 pm will hold the same value on each weekday within the given calendar month). This proposal mirrors the language from the original December 2021 PD.

- For residential customers, the ACC values are locked in for nine years and float thereafter.

- For commercial customers, the ACC values are locked in for five years and float thereafter.

- Following the lock-in period, export rates are based on hourly ACC values from the most recently run ACC adopted as of January 1. Customers can elect to opt-out of the lock-in period.

- The ACC is updated annually, with significant modifications occurring every two years.

- The table below shows illustrative weekday, 2023 hourly export values for PG&E.

“Glide Path” – Export Adder

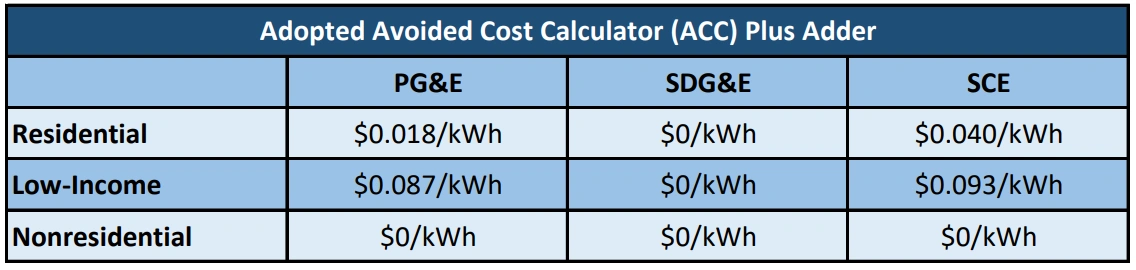

The revised PD proposes an “ACC Plus” adder, which would increase the export value during the first 5-years of NEM-3 to transition the market to the new tariff gradually. The table below specifies the ACC adder values based on market segment and utility.

- The ACC Plus adder will be credited to eligible customers for a period of 9 years.

- Non-residential customers, in addition to SDG&E customers, will not receive an ACC Plus adder.

- Adder values would decrease by 20% annually over five years until the adder reaches zero.

- ACC Plus credits can offset fixed and NBCs. Unused credits will roll over without expiring.

NEM-3 Implementation Timeline

The earliest date the revised PD could be voted out is December 15th. NEM-2 enrollment will end 120 days after the PD is finalized. This means the earliest possible NEM-3 cutover date is April 14th, 2023.

- The PD explicitly states that the qualification criteria for locking in NEM-2 status is submitting a completed interconnection application (IA). The PD states a completed IA “must be free of significant deficiencies and include a complete application, a signed contract, a single-line diagram, a complete CSLB Solar Energy System Disclosure Document, a signed California Solar Consumer Protection Guide, and an oversizing attestation (if applicable).” Note: ETB hopes to see more prescriptive language defining what constitutes a ‘significant deficiency’ or a ‘material change’.

- Customers that submit an IA after the sunset date will be temporarily billed under the NEM-2 tariff but will be transitioned to the Net Billing tariff once operationalized. No later than 12 months after the adoption of the PD, the IOUs shall complete the alignment of any related necessary billing systems and transition to full implementation of the new tariff.

- If the IA is submitted before the sunset date, customers will receive NEM-2 benefits for 20 years.

- There is no specified deadline to complete construction once the IA is filed and accepted.

Residential Electrification Rates

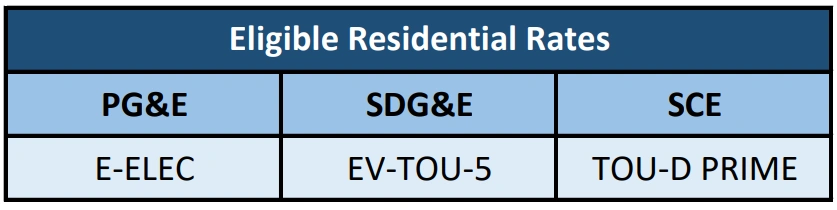

NEM-3 residential customers will be mandated to take service on a predetermined time-of-use (TOU) rate, which contains high differentials between peak and off-peak TOU periods. This rate structure provides strong price signals, encouraging customers to shift energy usage outside peak hours (e.g., 4 pm – 9 pm). Below is the initial set of residential rates required for Net Billing Tariff customers.

- Customers may enroll in Critical Peak Pricing (CPP)/Peak Day Pricing (PDP).

- Additional eligible rates may be added by utility request through the submittal of a Tier 3 advice letter or through its General Rate Case or Rate Design Window proceeding.

- There are no specific rate requirements for commercial and industrial (C&I) customers.

Additional NEM-3 Issues

Our summary above focuses on the most critical elements within the PD. There are numerous other important issues within the 241-page Proposed Decision, which we wanted to flag.

- Instantaneous netting. Previously in NEM-1 and NEM-2, solar exports to the grid were counted by netting exports over a time interval, 60-minutes for residential and 15-minutes for non-residential. The new PD proposes to count exports instantaneously by referencing two separate channels of meter data: imports and exports. The CPUC has estimated that instantaneous netting would lead to roughly 6% more exports being counted.

- Virtual Net Metering (V-NEM).The PD proposes no changes to VNEM and retains onsite netting, but changes will be considered at a later date.

- Net Meter Aggregation (NEM-A). Proposes to value all solar generation at export compensation rates, which would likely make NEM-3 NEMA arrangements uneconomical.

- New SGIP funding. Up to $900 million will be made available, with ~$630 million earmarked for low-income, residential solar and energy storage, and ~$270 million for non-low-income storage.

- Non-bypassable charge (NBCs) components remain unchanged. Public Purpose Program Charge (PPPC), Nuclear Decommissioning Charge (NDC), Competition Transition Charge (CTC), and Wildfire Fund Charge (WFC).

What Effect will NEM-3 have on Project Economics?

Solar. The value of solar bill savings and the project economics of PV-only projects will get eroded considerably once NEM-3 is implemented. This is caused by the average value of exported energy dropping roughly 75%, compared to current-day NEM-2. How much erosion occurs will depend on how much PV is exported to the grid. Solar projects with a high percentage of exports will see the most value loss. Residential projects that size the PV system to meet 100% of annual consumption and export over 50% of their production to grid will feel considerable savings erosion. Whereas a non-residential project that offsets a smaller percentage of consumption will export less and have less value loss.

Storage. NEM-3 will create a strong tailwind for the energy storage market in California. Sharply reducing the value of exports creates a strong price signal for pairing storage with solar to prevent exports and self-consume more energy. Additionally, the new ACC framework creates high hourly export values during certain periods of grid stress (e.g., 7 – 8 pm in September in PG&E will value exports at $2.87/kWh) creating a strong value capture opportunity for storage projects that can export to grid during these premium-priced hours. It is widely expected that storage attachment rates will go way up once NEM-3 is implemented. California interconnection data over the last 3 years shows storage attachment rates ranging between 10% to 15%. In a NEM-3 world, attachment rates will likely go upwards of 70% to 80%. This is similar to the current-day attachment rates in Hawaii which implemented a NEM program that crushed the value of exports back in 2015.

How to model NEM-3 scenarios in Energy Toolbase

Energy Toolbase users have had the ability to model NEM-3 scenarios in ETB Developer for over a year. We published a blog and hosted a webinar after the original December 2021 PD was released, where we overviewed how to run NEM-3 scenarios using a method that averages hourly export values over a TOU period. While this method does an adequate job of approximating the value of exports, it does not perfectly account for exported energy the way defining actual hourly ACC values would. This temporary workaround gives users a simple workflow that we believe is upwards of 90% accurate in determining utility bill savings in a NEM-3 world. We encourage users to continue using this method for now. Note: our in-house rates team loaded all the major residential and C&I rate tariffs with ACC values for exports last December when the original PD was released. Our rates team is currently working on loading the latest ‘effective date’ NEM-3 rates with updated ACC export values.

We are excited to announce that we are in the final stages of implementing a solution whereby exported energy is based on the actual hourly ACC export values. This will enable users to precisely model the value of exports, utility bill savings, and the overall project economics of any type of NEM-3 project. Our product and engineering teams are currently testing this fulsome solution, which we expect to have live in production in the coming weeks. We will communicate to our user base in California when this functionality launches. Lastly, it’s important to note that the PD is still a “Proposed” Decision and has yet to be approved. We will continue to monitor the NEM-3 proceeding and make any necessary updates in ETB Developer based on the adopted final decision.