There are a lot of reasons to be optimistic about the future growth of the commercial and industrial (C&I) energy storage market. At Energy Toolbase, we have seen this market up-close over the last 6 years, including a lot of the fits and starts. As we head into 2021, we are seeing several trends that make us bullish on the market. C&I energy storage system (ESS) proposal generation activity on the ETB Developer software platform has never been higher. In 2020 we recorded our sixth consecutive year of ESS proposal generation growth, which came against the backdrop of the COVID-19 slowdown. We are encouraged to see a continued widening out in the number of developers modeling and proposing ESS projects. In 2020 alone, nearly two-thirds of our ETB Developer userbase created proposals that included energy storage, and roughly one-third created at least ten proposals with ESS. A strong funnel of deal flow is a prerequisite for projects to get deployed. Furthermore, developers are getting more efficient at quantifying the economics of solar and energy storage projects. They are also improving the way they present and communicate the value of storage to end customers. In the C&I sector, this is especially important as the value proposition can vary significantly depending on the customer’s location and utility rate schedule. In this article, we unpack the signs that make us optimistic going into 2021.

C&I ESS market tailwinds

The commercial energy storage market has tailwinds behind it. Battery prices are expected to continue declining, which will create more attractive project economics. BloombergNEF’s Battery Price Survey estimates that average battery pack prices will fall to around $100/kWh by 2023, down from $156/kWh in late 2019. The policy landscape is also quite supportive of storage. New behind-the-meter (BTM) incentive programs are coming online in states like Massachusetts and New York, and hopefully, others will follow. This will help to broaden the market outside of California, which has dominated non-residential deployments thanks in part to the Self Generation Incentive Program (SGIP).

Utility rate designs and net energy metering (NEM) frameworks are also continuing to evolve rapidly. This is usually bullish for storage as most changes erode the value of BTM solar, which creates a savings opportunity for storage. On the federal side, FERC Orders 841 and 2222, which we discuss in more detail later, pave the way for BTM storage to participate and receive financial compensation in wholesale energy markets. Additionally, the recently extended solar ITC is positive for solar and energy storage projects, which will now continue to receive the 26% tax credit through 2022. And with incoming President Biden saying on-record that he wants more storage, the industry is hopeful that the new administration can deliver a standalone energy storage tax credit.

Non-residential has lagged the broader market

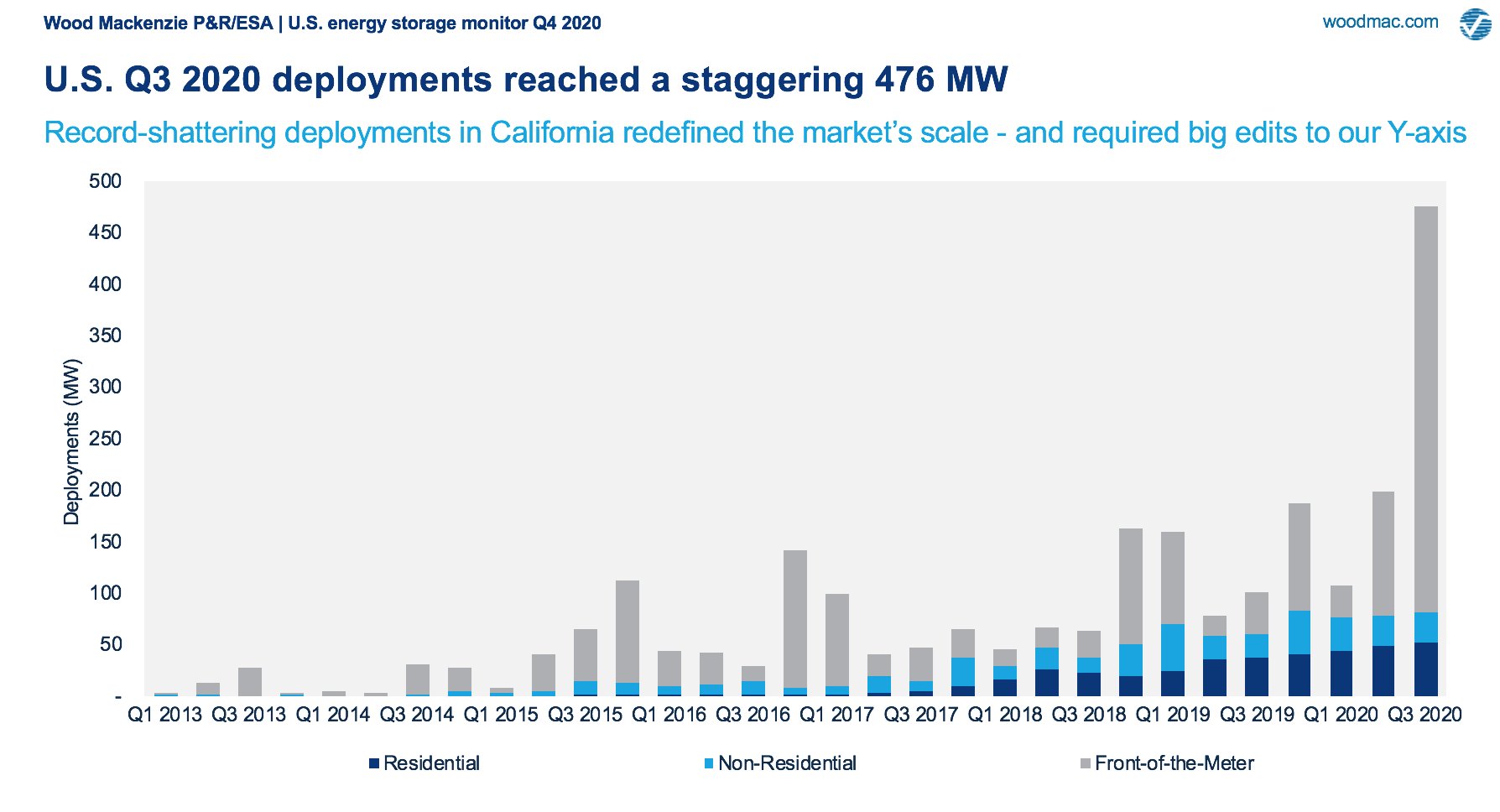

Wood Mackenzie’s most recent Energy Storage Monitor report shows that the non-residential sector has lagged in both the Front-of-the-meter (FTM) and residential segments. In Q3 2020 total ESS megawatt deployments grew 240% quarter-over-over. The FTM sector surged 330%. The residential sector grew 7%, which marked its 6th consecutive quarter of growth. Meanwhile, the non-residential segment shrank by 3%.

The non-residential market has its share of unique challenges. Compared to residential, C&I project development is more complex and requires a strong command of how to optimize local utility rate structures and incentive programs. Additionally, the way in which C&I ESS captures value is more customized and can vary significantly from market to market. Like C&I solar projects, sales cycles are longer and project financing is not as off-the-shelf. While the residential ESS market is primarily driven by demand for resiliency and back-up power, C&I customers have historically been motivated first by getting a good return on investment. In other words, most non-residential ESS projects must pay for themselves. Also, C&I projects do not have the FTM benefit of large pipelines of utility procurements and non-wires alternatives projects, where batteries get deployed instead of making grid upgrades.

Utility Bill Savings

The primary way that a commercial ESS captures value and generates revenue is through utility bill savings. In a behind-the-meter setting there are generally three ways in which storage can be used to reduce a customer’s utility bill:

- Demand charge management (aka peak-demand shaving) utilizes the battery to reduce a customer’s peak demand and corresponding demand charges. On many C&I rate tariffs, it is common for demand charges, which bill based on the amount of power a customer uses at any one point in time, to make up half of a customer’s bill.

- Time-of-use (TOU) arbitrage utilizes the battery to profit from the price differences between a customer’s TOU rate tariff. It accomplishes this by charging the battery when energy is cheap (e.g., off-peak) and discharging back when energy is expensive (e.g., on-peak).

- Self-consumption is when storage gets paired with a solar PV system and the ESS is used to prevent exporting energy to the grid. In markets like Hawaii, exported solar PV production to the grid gets valued at a significant discount, which creates an opportunity to self-consume and captures the difference between the retail and export rate.

How much avoided cost a customer can capture is a function of the utility rate schedule they are on. Some C&I rate tariffs offer a strong price signal for storage (e.g., high $/kW demand charges and/or wide $/kWh TOU price differentials), which creates an advantageous opportunity for storage to reduce the bill. Conversely, some rate tariffs offer weak or marginal price signals. For some customers, it is impossible to make storage pencil out when evaluated purely on bill savings. Therefore, it is mission-critical for developers to showcase the other types of value storage can provide, which we will unpack below.

Future-proofing

One of the unique features of energy storage is its versatility and ability to capture value in different ways. This flexibility enables ESS to adapt to policy changes in utility rate design and NEM frameworks, which often erode the value of solar. When ESS is paired with solar it acts like an insurance policy by future-proofing savings that get eroded.

The Hawaiian market is a good example of a policy change that significantly eroded the value of solar and created an opportunity for storage. Regulators in Hawaii crushed the solar export value when they sunsetted their NEM program in 2015. Today, Hawaii has the highest storage attachment rates in the country. Solar system owners often need to attach storage to prevent exports and make their project economically viable. California may be next, as the high stakes NEM 3.0 proceeding is expected to get a final decision in 2021. It’s not far-fetched to envision a future where pairing ESS with PV will become a requirement in many markets.

Utilities are accelerating the rate at which they are proposing changes. N.C. Clean Energy Technology Center’s most recent 50 States of Solar report found that 42 states took a combined 146 distributed solar policy actions in Q3 of 2020 alone. 17 states were working on successor tariffs to reduce NEM compensation.

Resiliency

Demand for solar and energy storage to provide backup power and resiliency in the event of a grid outage is growing in the non-residential sector. This is especially true for customers located in high threat natural disaster locations. While this is helping to drive ESS demand, it is difficult and subjective to quantify how much monetary value resiliency provides. A customer located in a high threat fire district in California that has life-sustaining loads may place a very high value on resiliency. While another customer may not want to attribute any value.

The non-residential energy storage market would benefit greatly if we could attribute monetary value to resiliency in the cash flow model to supplement utility bill savings. The Clean Coalition recently published a value-of-resilience (VOR) formula, which attempts to standardize how resiliency gets quantified. Their VOR methodology categorizes electric loads as critical, priority, or discretionary. The Clean Coalition suggests “using the conservative figure of 25% as the typical VOR adder that a site should be willing to pay for indefinite renewables-driven backup power to critical loads”.

Grid Services

Behind-the-meter storage can provide strong benefits to grid operators, including frequency regulation and peak capacity investment deferral. But most BTM storage projects today are not doing this and therefore not receiving financial compensation for it. This missed opportunity is going to change soon.

In 2020, the Federal Energy Regulatory Commission (FERC) passed two landmark orders: FERC 841 and FERC 2222, which will pave the way for distributed energy resources (DERs), like BTM storage to participate in wholesale markets. FERC Order 841 directs regional grid operators to remove barriers for storage to compete on a level playing field in wholesale markets. FERC Order 2222 directs interstate regional transmission organizations (RTOs) and independent system operators (ISOs) to develop rules that allow DERs and DER aggregations to participate in these markets. These orders could be momentous and pave the way for DERs to receive financial compensation in capacity and ancillary services markets. In the not-too-distant future, C&I storage projects may be able to tap both BTM utility bill savings and wholesale market revenue streams. This could be a game-changer.

Optimistic on future growth

The C&I ESS market has its share of challenges to work through. But we have many reasons to be optimistic about the future growth of this huge addressable market. At Energy Toolbase we’re seeing a lot more proposal generation from an increasing number of developers, which indicates the market is broadening. We are confident that value capture opportunities for storage will continue to improve. This will come in the form of changing rate structures and NEM frameworks, as well as more value attribution for resiliency, and grid services revenue opportunities coming online. C&I storage will move beyond just counting utility bill savings in the cash flow model. Additionally, the market has strong tailwinds from declining battery prices and a favorable policy environment. We think this confluence of factors will enable the non-residential segment to beat deployment growth projections over the coming years.