Energy Toolbase’sDeveloper product has revolutionized the economic analysis of solar and energy storage projects. It provides a rapid way to model project economics accurately. As you evaluate an opportunity, one of the questions that should be asked, especially in an increasingly complex energy landscape, is whether adding a battery energy storage system (BESS) to your project makes financial sense. Fortunately, some back-of-the-napkin math can be used to determine the answer to the question and figure out the optimal way to price your solution for an attractive pitch to your customer.

Step 1: Do Some Initial Modeling

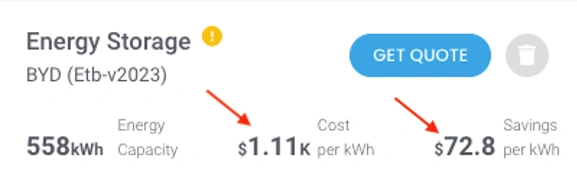

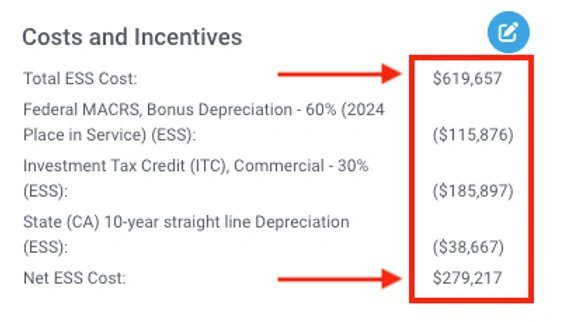

We need to do some work inside of Developer. To begin: add your Energy Use Profile, select the correct rate schedule, add an appropriately sized PV system, include the applicable incentives, and then add Energy Storage. Once this is complete, you should see the following header and footer sections in your proposal’s Energy Storage System column:

Figure 1 – Energy Storage System Header

Figure 2 – Energy Storage System Footer

Step 2: Grab a Note Pad and a Pen

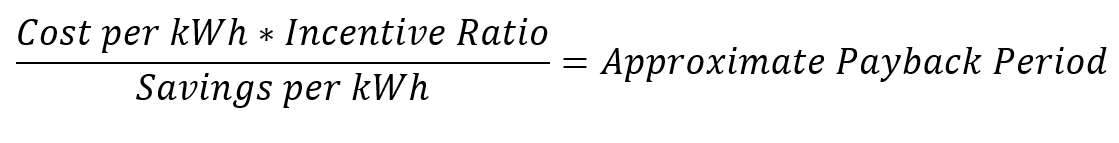

Using the annotated values from the figures above, we can do some quick math to determine the ESS’s impact on the project’s payback period. The equation we’ll be working with is as follows:

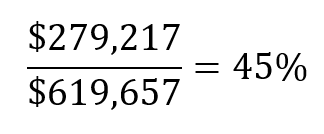

1. Use the Total ESS Cost and the Net ESS Cost to determine the incentive ratio. For example, using the numbers in Figure 2 above:

2. Apply this incentive ratio to the payback period equation along with the values in Figure 1:

The result is an approximate payback period of the ESS system. It’s important to note that depending on the effects of the PV system that you specified in the initial modeling, the payback period may be different from the overall project’s payback period. It’s also worth noting that this simple approximation doesn’t consider real tax applications (like depreciation) or energy escalation. The equation above is best used to inform more detailed decisions.

Step 3: Maximize the Results

Now that we’ve established our evaluation system, we can use this to our advantage and solve for any variable in the equation.

For instance:

- We can solve for the Cost per kWh by fixing the other variables to help us set our solution’s pricing.

- We can identify a target for the Savings per kWh to understand if we need to investigate other value streams for our project, for instance, participating in a Demand Response Program or adding a different incentive.

It’s also important to understand a few guidelines for evaluating the variables in the equation:

- A 10-year payback period is unattractive as your battery warranty will generally expire before the original investment is recovered.

- A 7-year payback period is verging on an attractive project; if you can increase the Savings Per kWh or decrease the Cost Per kWh and Incentive Ratio, this project could become an excellent investment.

- A 5-year payback period is generally a phenomenal investment. By increasing the Savings per kWh, you will also be able to increase the Cost per kWh, which will include any margins you can make on the project.

Adding a BESS to the proposal may increase your overall project payback period, prompting the question, “Why increase the payback period by integrating storage?” Two key reasons drive this decision. First, adding storage to a project yields much lower energy bills than solar alone. Second, intelligent storage controls like Acumen EMS™ help secure project financials by targeting new value streams as rates, incentives, and programs change. For example, a BESS can enable you to transcend solar limitations in prime solar markets like California or Hawaii. It can recapture solar energy that would be lost due to export restrictions, target windows to export energy where export prices are high or participate in demand response programs with excellent accuracy and impact.

Conclusions

This simple method can enable you to decide whether to propose an Energy Storage System for each opportunity you pursue. It can also help you find the ballpark for how to price your solution. Finally, after evaluating a few sites, it can be used to strategically determine if a market is particularly attractive for your business. Once you’ve run the approximate numbers, do a detailed analysis in ETB Developer, and create a beautiful proposal for your customer that highlights the excellent investment that your proposed solution provides.