Understanding the complex regulatory environments that shape how energy is produced and delivered is vital to successful solar and energy storage modeling and deployment. Whether you’re designing a virtual power plant, optimizing battery dispatch, or integrating solar into commercial portfolios, knowing how to work in a regulated or deregulated energy market is necessary for project success.

In this article, we break down the differences between regulated and deregulated energy markets, provide important things to know when working in each, and explain how to use ETB Developer features to simplify modeling rate schedules depending on the market you’re working in.

What are Regulated and Deregulated Energy Markets?

The key difference between regulated and deregulated energy markets lies in who supplies electricity and how prices are determined. In a regulated market, a single utility company controls the generation and delivery (transmission and distribution) of electricity. (Generation and delivery services combined is commonly referred to as bundled service.) This utility is governed by a state public utilities commission, which sets rates and ensures reliability and service standards. Customers in regulated markets typically have little to no choice in who supplies their electricity and must work within the confines of their utility to reduce their bills and improve efficiency.

In contrast, deregulated markets provide unbundled energy services, meaning the generation, transmission, and distribution are separated, thus allowing customers to choose an electricity supplier from a pool of competitive energy retailers. These energy retailers are often referred to as third-party suppliers, retail energy suppliers (RES), or retail energy providers. Utilities in deregulated states still own and maintain the infrastructure for delivering electricity (poles, wires, meters) and bill their customers for the upkeep of this infrastructure, but the electricity itself can be purchased from different companies offering varied plans and pricing, including fixed rates, variable rates, and even renewable energy packages. Customers in these markets can look outside of their primary utility for options and plans that better suit their individual needs and consumption habits.

Which States Have Deregulated Energy Markets?

There are different degrees of deregulation across the states; the following list includes states that are fully or partially deregulated:

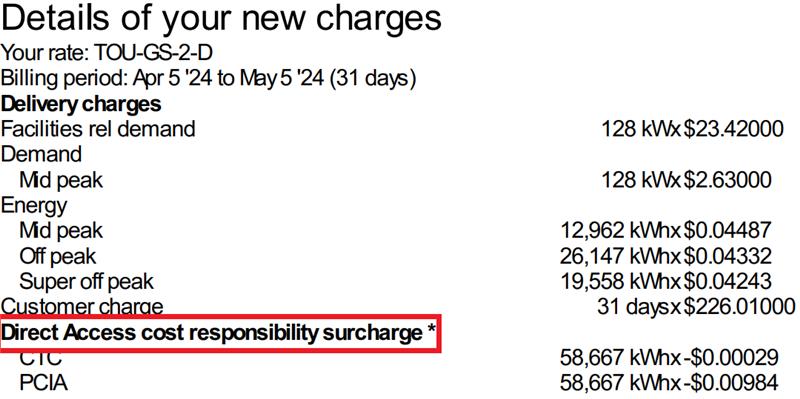

California is unique in that it is partially deregulated and refers to customers receiving supply from an RES as Direct Access (DA). DA in California is limited to commercial and industrial customers and has caps in place to limit the amount of electricity that can be served through DA. If you ever see “DA” in the rate name on a California bill or “Direct Access” mentioned on the bill, then the customer most likely receives their supply charge from an RES.

Things to Know When Working in a Deregulated Market

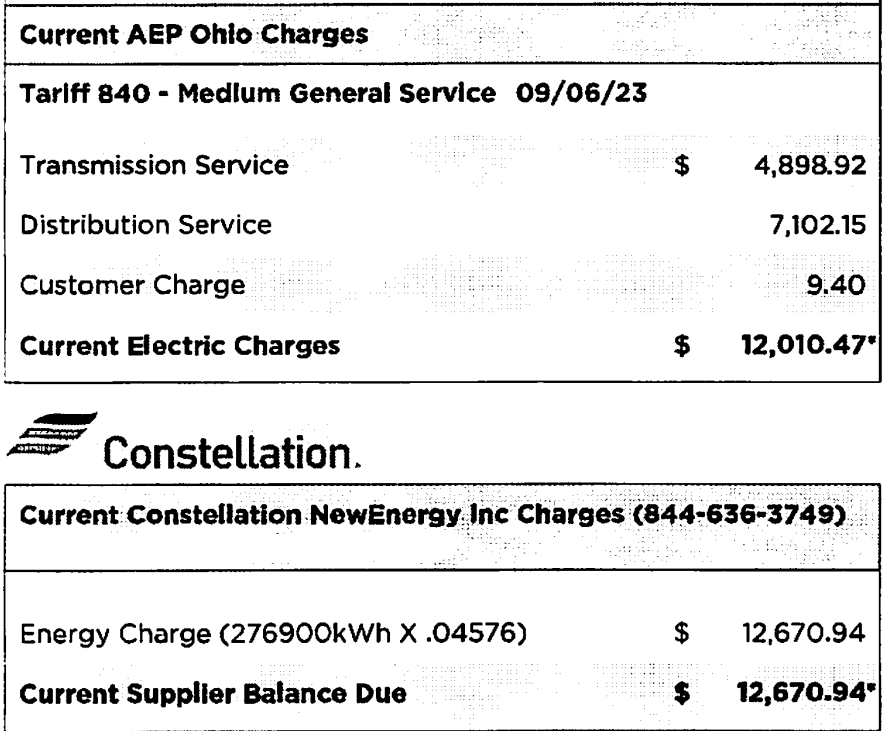

Working in regulated energy markets is straightforward since customers receive bundled service directly from their utility, while working in deregulated markets often provides more complexity due to the involvement of third-party suppliers. One important thing to know as a developer working with customers in deregulated energy markets is that they might receive dual billing—one from their primary utility and one from their RES. Sometimes, the RES charges and totals are included on a customer’s utility bill, while other times a customer receives two different sets of bills. Take the following bill for example:

The customer is billed customer, transmission, and distribution charges from their utility, AEP Ohio, with no generation charge line item listed. That’s because Constellation, the RES, is billing the customer at a different supply rate, which is included on the same bill. If the RES charges were not present on the bill, then the absence of generation charges is a good indicator that the customer receives service from an RES and is likely receiving two sets of bills, both of which are necessary when running a financial analysis or preparing a proposal.

Another thing to keep in mind when working with customers in deregulated energy markets is that net metering policies can vary significantly depending on the state and RES. Unlike some traditional utility companies in regulated markets, RES are not always required to offer net metering. In many deregulated states, net metering is a voluntary offering by an RES; some may offer full retail net metering while others offer partial credits or none at all. This complexity can impact the economics of solar, especially if the credit rate is lower than the retail rate or if credits are not rolled over month-to-month. That’s why due diligence when reviewing the terms for an RES’s net metering policy is crucial.

A potential way of boosting solar project economics in markets with unfavorable net metering options is energy storage. An energy storage system can provide more opportunities for value and savings by maximizing on-site consumption and reducing reliance on export credits. The best way to achieve this value is with an intelligent and comprehensive energy management system like ETB Controller with Acumen AI™. ETB Controller provides maximum results for your energy storage system with its automatic AI-enabled value stream and cost management by prioritizing the most efficient and beneficial strategy for your system at any given time.

ETB Developer Features for Deregulated Markets

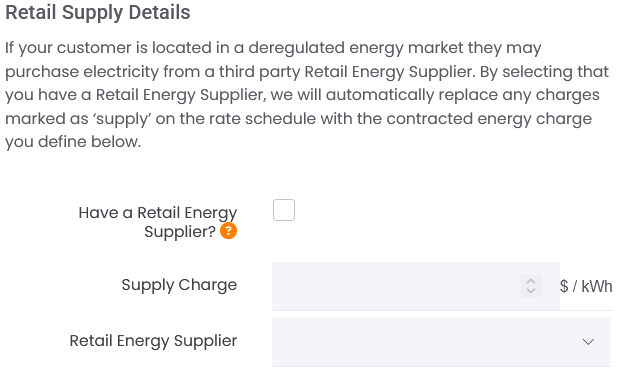

Our ETB Developer platform provides many tools and features for users to handle the nuances of working in regulated or deregulated energy markets. The Retail Supply Details feature makes it simple to include the supply charge from an RES. You simply select the utility and rate schedule the customer is on, then check the box and input the supply charge from the RES. This is possible thanks to our vast database of global rates (over 100,000) and the ability to label individual line items within a rate schedule as supply or delivery.

ETB Developer users also have the ability to create and edit their own rate schedules to account for more complex RES billing, and they can customize the net metering details to match the RES’s specific policies.

Working in regulated and deregulated markets has never been easier with our ETB Developer platform. You can sign up for a 14-Day Free Trial for ETB Developer to start modeling your projects today!